Why are batteries relevant for a Proptech fund ? - Our Convictions on the Battery value chain

For some years now, Li-ion batteries have been at the heart of economic and geopolitical news. The VC ecosystem is also directly impacted, as shown by the record-breaking round of FR startup Verkor, which raised two billion euros in September 23 to build a giga-factory dedicated to battery production in northern France. From our point of view, this is just the tip of the iceberg, as not a week goes by without the emergence of new European startups addressing this value chain and tackling new use cases. After being associated primarily with mobility, first or second-life batteries are about to penetrate buildings and urban centers.

More specifically, we’ve seen batteries disrupt the proptech ecosystem in recent years due to three macro-trends: 1/ The growing electrification of building systems (electric heating, smart home appliances, charging infrastructure for EVs, electrification of construction works...) ; 2/ The increase in renewables in the EU energy mix - which generates a higher variability in electricity production and a greater need for storage to meet real-time demand ; 3/ An increasingly attractive business case for battery deployment, with the three-fold effects of rising electricity prices, end-of-life batteries starting to come back on second-life market, and falling battery production costs (according to RMI, battery costs are set to halve over the coming decade).

And these 3 trends are here to stay: Statista’s Research Department projects that between 2022 and 2030, the global demand for lithium-ion batteries will increase almost seven-fold, reaching 4.7 terawatt-hours in 2030. In light of this, we believe it makes sense for a Proptech fund to look at batteries. With the expertise of our partners Vinci Energies and RTE, and in the wake of the launch of our Greentech Industries fund, we have been closely monitoring these subjects. This resulted in our first investment in 2023 in FR company Mob-Energy, a startup that leverages second-life batteries to commercialize plug-and-play EV charging hardware for parking lots.

From a dealflow perspective, we’ve also identified three market opportunities that we find relevant, and on which we focus our attention:

1/ Battery Analysis & Monitoring

Batteries are expensive technological assets with a limited lifespan (a conventional EV battery reaches end-of-life after 10 or 15 years, and accounts for 40% of EV price). At a fleet/large scale, operators therefore have a strong need for data-driven decision support, to improve battery management and control along the value chain. This is where pure software plays dedicated to battery analysis and real-time monitoring can deliver value. For example, the startup Entroview develops an analytics solution to optimize battery quality before they leave the factory, based on physical parameters like entropy. Along the operational phase, French startup Bib-Batteries has created a SaaS to monitor micro-mobility batteries state-of-health in real time, taking into account factors such as charging frequency, duration of cycles, as well as potential defects.

2/ Batteries for buildings and on-site systems

Deploying a battery on site requires complex systems combining hardware and software. These systems must enable interoperability with other on-site devices, traceability of flows to enable the implementation of trading solutions with the grid, and efficient hardware management. In this field, companies can be distinguished by the size of the storage infrastructures they deploy: on the scale of the electricity network, on the scale of a single site, or on the scale of a single device. For instance, Storio, a FR early-stage startup, aims to deploy and operate systems for large industrial and commercial sites (battery power from 100kW to 2MW), enabling them to store surplus energy produced directly on-site, while Eclipse, another FR early-stage startup, aims to balance the grid by building large storage sites (ie battery power of several MW) capable of absorbing grid surpluses for trading or providing flexibility services to the network.

3/ Batteries Operations & Circularity

According to McKinsey, over 100M EV batteries are expected to reach end-of-life globally in the next decade, with around 35M kWh of batteries reaching end-of-life in Europe per year by 2030. A new value chain is therefore emerging at the end of batteries life, based on the orchestration of their reuse, repair or recycling (a typical end-of-life EV battery still has a residual capacity of around 70-80%!). Startups can offer a mix of solutions, from matchmaking between supply and demand of second-life batteries coupled with operational/logistics services, to more hardware-oriented plays related to battery repairs, or even recycling itself. Two examples : Oslo-based Clingsystems enables operators to quickly identify second life opportunities for their end of life batteries through a tech-enabled marketplace, while FR company Mecaware has developed an innovative process leveraging CO2 capture to recycle battery production scrap.

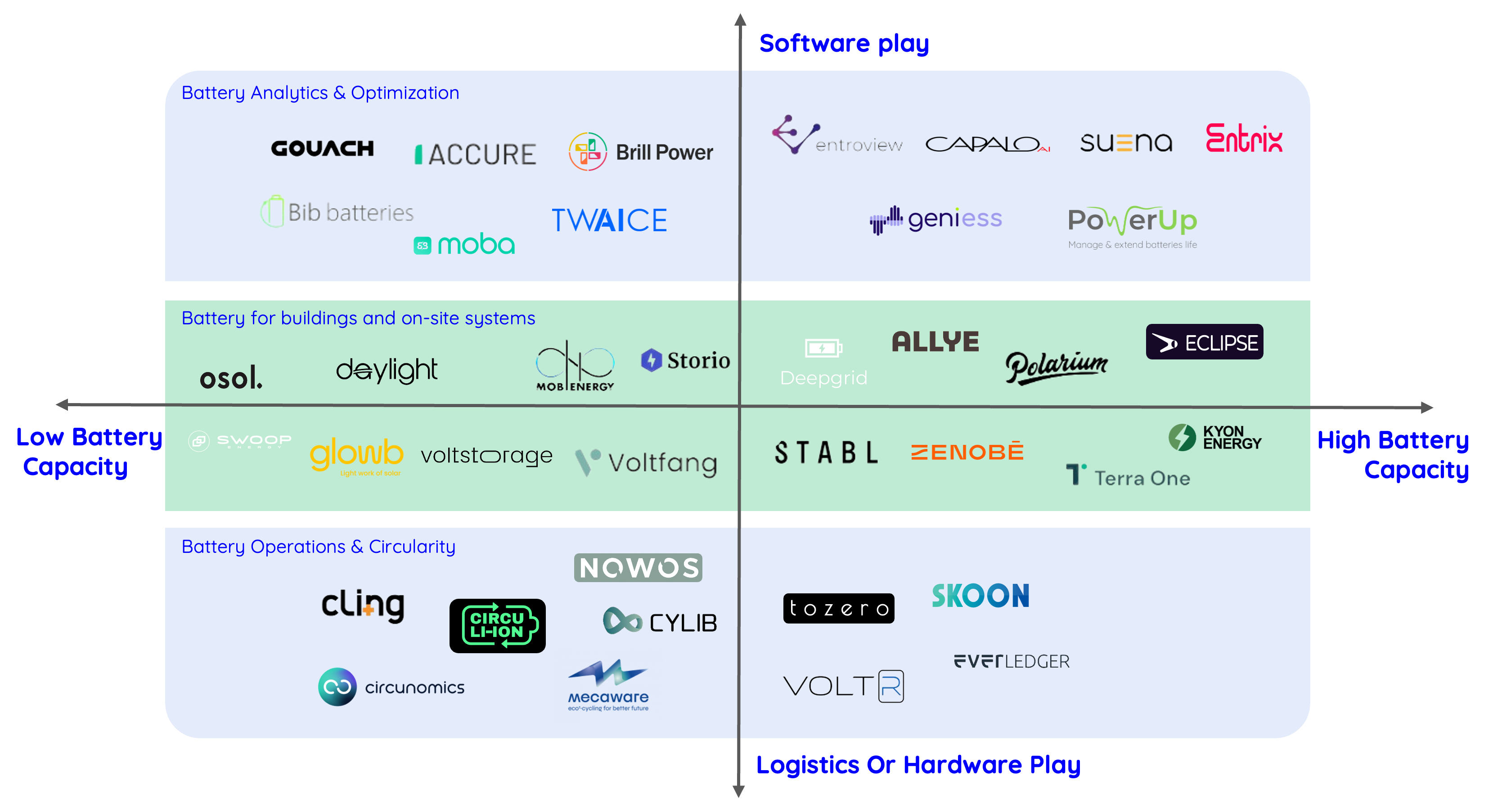

The following graph illustrates some of the companies that we mapped on these three use cases :

By analyzing over 100 cases on these subjects, we’ve acquired some convictions on what we believe to be the success factors for a new tech project entering the battery value chain. Here are three of these convictions.

1/ First, perhaps more than in any other area of proptech/contech, a team with a wide range of skills is needed.

We argue that building a business involving batteries is more complex than a regular vertical proptech marketplace or SaaS, as it touches on several subjects: energy trading, operations and logistics, hardware production, analytics and data. To build a successful battery-related business, it's essential to have a team with a solid technical expertise that reflects the diversity of this knowledge – without neglecting commercial access to key industrial players (construction, logistics, facility management…) that can be key to unlock first clients. This was one of the main factors in our decision to invest in Mob-Energy: all three founders are engineers, and each of them has a strong expertise in part of the value chain (software skills to build the smart charging piece, electrical engineering skills to design battery power banks, and industrial skills for mass-produced hardware systems).

2/ Second, we believe that the software layer is the most accessible and easiest differentiating factor to create between battery operators.

An on-site battery system ultimately consists of three elements: a site/location, a hardware (the battery cells) and a software layer. To create barriers to entry, startups can choose to innovate on one or more of these three elements. But some moats are harder to create than others. For example, it’s hard to differentiate on the hardware side, as most startups deploying storage systems rely on existing hardware, which is relatively standardized - for this a solution might be to use second-life batteries (like Mob-Energy), but this raises other issues linked to the supply of second-life cells, or to the implementation of internal testing processes. Similarly, it’s difficult to differentiate on site/location acquisition strategy : apart from relying on partnerships with DSOs, there are few ways of securing access to the best sites before competitors. By contrast, however, we think there's room for differentiation on the software side. By forecasting energy prices, battery optimization software can orchestrate real-time switching between the different revenue streams of the battery (energy self-consumption, intraday trading, grid services…) and generate a lot of value. For example, Suena Energy is developing software to efficiently manage battery installations, achieving significant gains over standard battery management protocols. With good availability of past European energy data, such tools can be designed and trained by a good in-house software team, and constitute for us the most accessible differentiating factor for battery operators.

3/ Finally, we argue that there is a real advantage in building an end-to-end offering across the battery value chain.

The battery value chain is complex, with many highly interconnected stages. This can create opportunities for startups to expand down the value chain. For example, launching a dedicated battery analysis software can pave the way for battery operations management. This is the case of Bib-batteries, which uses the precise knowledge it obtains from its battery analysis tool to suggest to operators the most suitable end-of-life opportunity (reuse /recycling / repair) for each monitored cell. Another example of the benefits of building an end-to-end battery business is that of German startup Terra One : by planning, developing and operating grid-scale energy storage projects in-house, the team expects to significantly reduce costs compared to buying ready-to-build (or operational) projects, and can therefore sell optimized IRRs to potential investors. Other than moving down the value chain, BESS developers can also leverage the connectivity of their systems with other energy devices to broaden their offering and facilitate go-to-market. Solar panels, for instance, as an energy production option, are highly complementary to storage systems. For example, in France, in the wake of the "Climate and Resilience" law - which encourages large buildings owners to deploy solar panels on their roofs, BESS developers have a strong interest in creating joint offers with solar developers, to equip customers with an all-in-one connected system (production + storage).

Of course, there are still many uncertainties regarding the speed and scale of battery deployment in Europe and in France: appetite of banks and financial institutions to finance electricity storage projects, ability of EU giga-factories to compete against Asian suppliers, end of ARENH in France and uncertainty over the future of electricity prices in 2025, desire of big corporates (solar or wind developers, automotive companies…) to fully internalize battery analytics and management considering how strategic it can be for them (one automotive company actually used the expression “nuclear codes” to illustrate how strategic battery data was for them in one of our ref calls!)… However, these uncertainties haven't stopped battery related startups from becoming a strategic investment choice for European proptech VCs in recent years.

At Axeleo Capital, we are following all this very closely, and we believe that Mob-Energy will not be our only investment in this space. Of course, feel free to reach out if you're thinking about launching a battery related venture!